How to Read Your StockLocks Report

Add StockLocks to your home screen. When you tap the icon, the website opens just like an app. You can receive notifications from the web app and quit the web app like you would any other app.

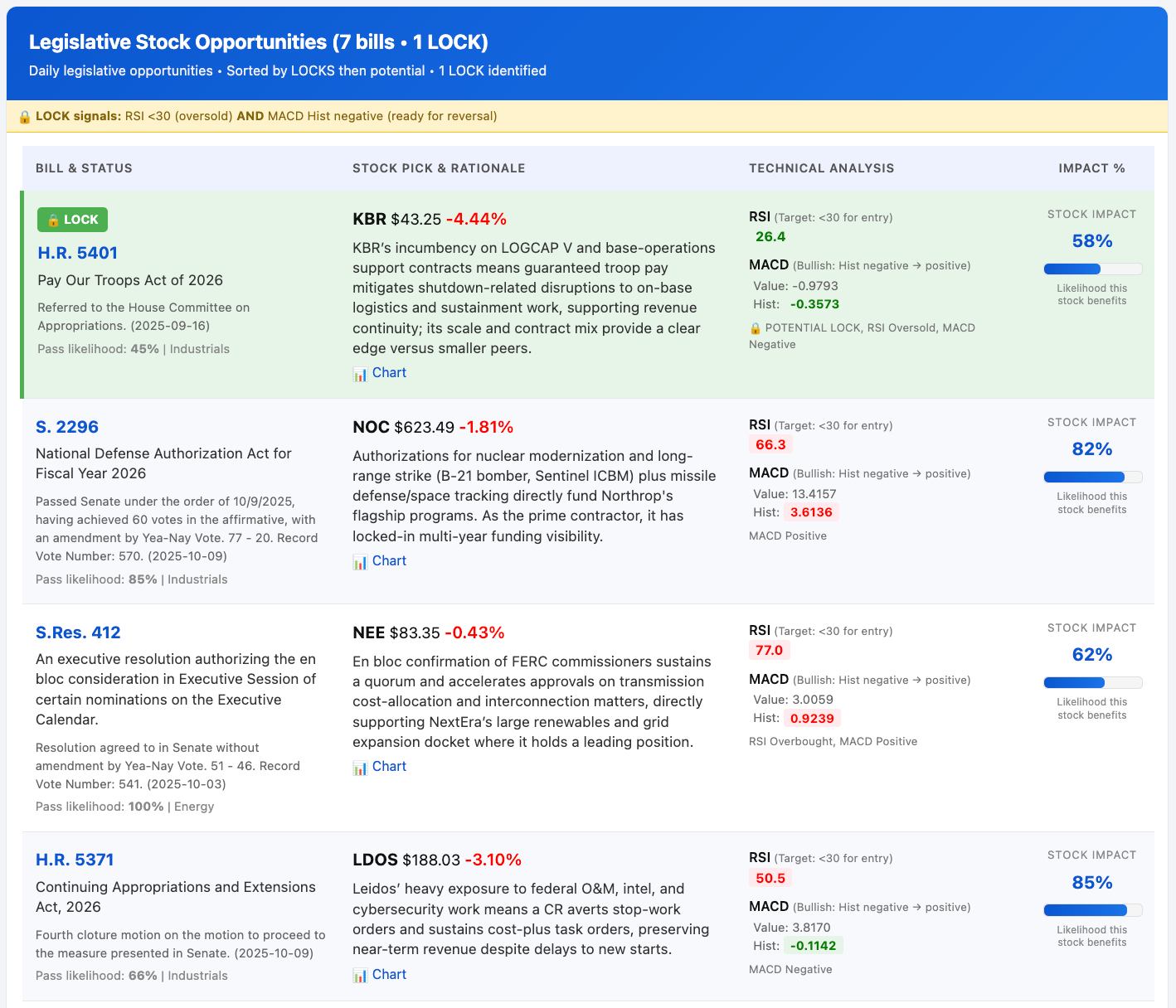

Step 1: Spot the “LOCK” First

- Look for the green “LOCK” tag, this is your high-confidence signal.

- In the example, H.R. 5401, $KBR is marked as a LOCK.

- The related stock, KBR ($43.25), shows a green RSI number (26.4).

- That green number simply means the stock has fallen more than usual and is now in a “bounce-back” zone. This is often a point where prices start to rise again.

- In the same box, you’ll see a green MACD label.

- Think of this as a quick “momentum check.”

- When it turns green, it means the stock’s downward speed is slowing and buyers are starting to come back in.

- This shift in direction, shown by the negative MACD histogram , helps confirm that the pullback may be ending.

When you see both a green RSI and a green MACD, the system flags the stock as a LOCK, a setup where a short-term rebound is most likely. Interpretation: This is your strongest indicator of a potential upside opportunity.

Step 2: Understand What Makes a LOCK

A LOCK happens when two indicators line up to show that a stock may be ready to rebound:

- RSI below 30: This means the stock has dropped more than usual and is considered oversold, often signaling a potential bounce.

- MACD Hist is negative: This means the stock’s momentum has slowed down, but is starting to shift upward.

When both appear, the system automatically flags the stock as a LOCK.

Step 3: Identify “Almost Locks”

If the RSI or MACD values are getting close to lock levels, they’ll appear in black instead of red.

In the example, FOXA ($57.27) shows black RSI numbers, meaning it’s approaching the oversold zone (RSI below 30) but isn’t quite there yet.

Here’s how to read the colors at a glance:

- 🟩 Green numbers: Confirmed LOCK for that technical indicator. It has reached key levels.

- ⚫ Black numbers: Almost there, getting close to LOCK status.

- 🔴 Red numbers: Overbought or extended, less likely to move higher soon.

Tip: Stocks showing black RSI or MACD values are next in line to become LOCK candidates, so keep an eye on them.

Step 4: Connect the Dots

- Combine legislative probability with technical setup:

- A bill with high pass likelihood (e.g., 80%+) and a stock in LOCK or near-lock territory is your top priority.

- Example from the report:

- KBR (LOCK) → RSI 26.4 (green), MACD confirming upward potential

- FOXA (Almost LOCK) → RSI 38.0 (black), MACD confirming upward potential. Nearing the same setup

Step 6: Use It Daily

Each day’s report lists the latest top legislative setups and any new LOCKS identified.