About StockLocks

Every morning we deliver the list of trending bills, the public companies affected, a probability-of-passage score derived from sponsor profiles and committee paths, and key technical indicators (RSI, MACD, volatility). When all signals align, we flag it as a ‘Lock’.

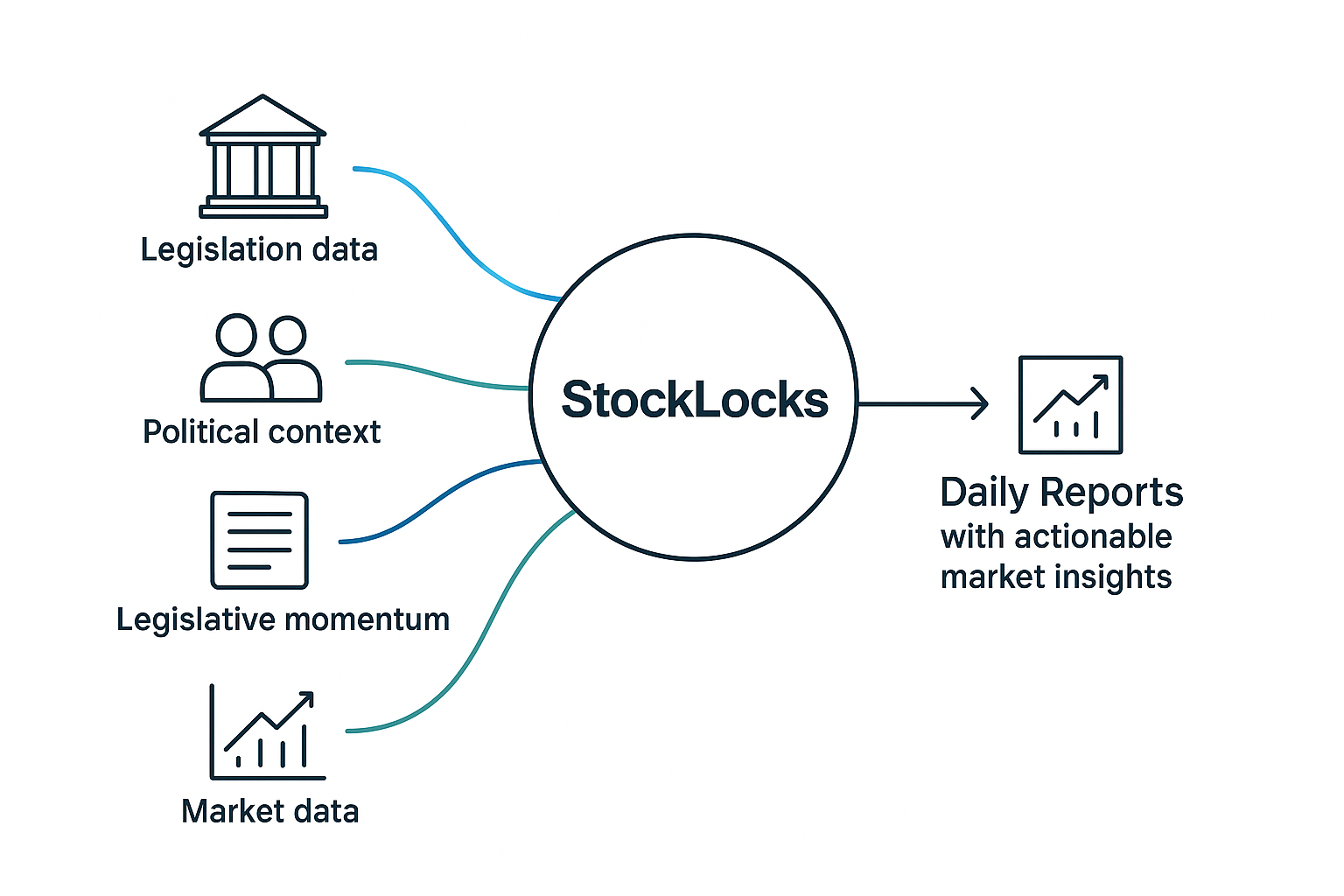

What We Do

We bridge the information gap between Capitol Hill and Wall Street with a structured, data driven workflow that monitors bills, scores their momentum, maps likely market impact, and surfaces tradable setups each day.

How It Works

- Track new and trending legislation from official sources such as Congress dot gov and related APIs.

- Analyze policy momentum using sponsor profiles, committee paths, historical voting patterns, and fiscal notes.

- Estimate probability of passage with AI powered scoring.

- Map market exposure by linking bill content to affected sectors and publicly traded companies using historical impact patterns.

- Pull real time market data including price, RSI, MACD, and volatility to detect momentum or reversal signals on impacted tickers.

What You Get Each Day

• Key legislative developments ranked by probability of passage and potential market effect

• Linked ticker lists with current price, RSI, MACD, and volatility metrics

• Highlighted “Locks” where policy and technical signals confirm an actionable setup.

• Direct reference links to source legislation and real time charts.

Who It Is For

• Active traders seeking policy aware setups

• Research teams that need structured legislative intelligence

• Institutional desks looking for early signals on policy driven moves

Why StockLocks Instead of Other Feeds?

Other platforms validate the importance of policy to market data, but they focus on transparency rather than prediction. StockLocks adds probability scoring, signal integration, and daily automation, turning raw policy data into forward looking and actionable insight.